WE'RE STILL OPEN TO HELP YOU FILE TAXES

File now to potentially avoid a growing pile of penalties, interest, and a higher tax bill.

CHECK YOUR REFUND STATUS

Information is updated once a day on the IRS website.

YOUR TRUSTED TAX EXPERTS FOR LIFE

We're not just local tax experts, we're your neighbors, and we're here to serve you. We take pride in the products and services we provide and are willing to go the extra mile for you and your family. Find out why our clients choose us year after year for tax planning and preparation.

WE'LL GET TO KNOW YOU & YOUR TAXES

We'll walk you through what you need to know about your taxes and guarantee your maximum possible refund.*

1997

COMPANY FOUNDED

Virginia Beach, VA

2,500+

LOCATIONS

Across the U.S.

100%

SATISFACTION

Guaranteed

4.5 OUT OF 5

ON GOOGLE REVIEWS

Since 01/01/2021

87.2%

POSITIVE REVIEWS

Google Reviews

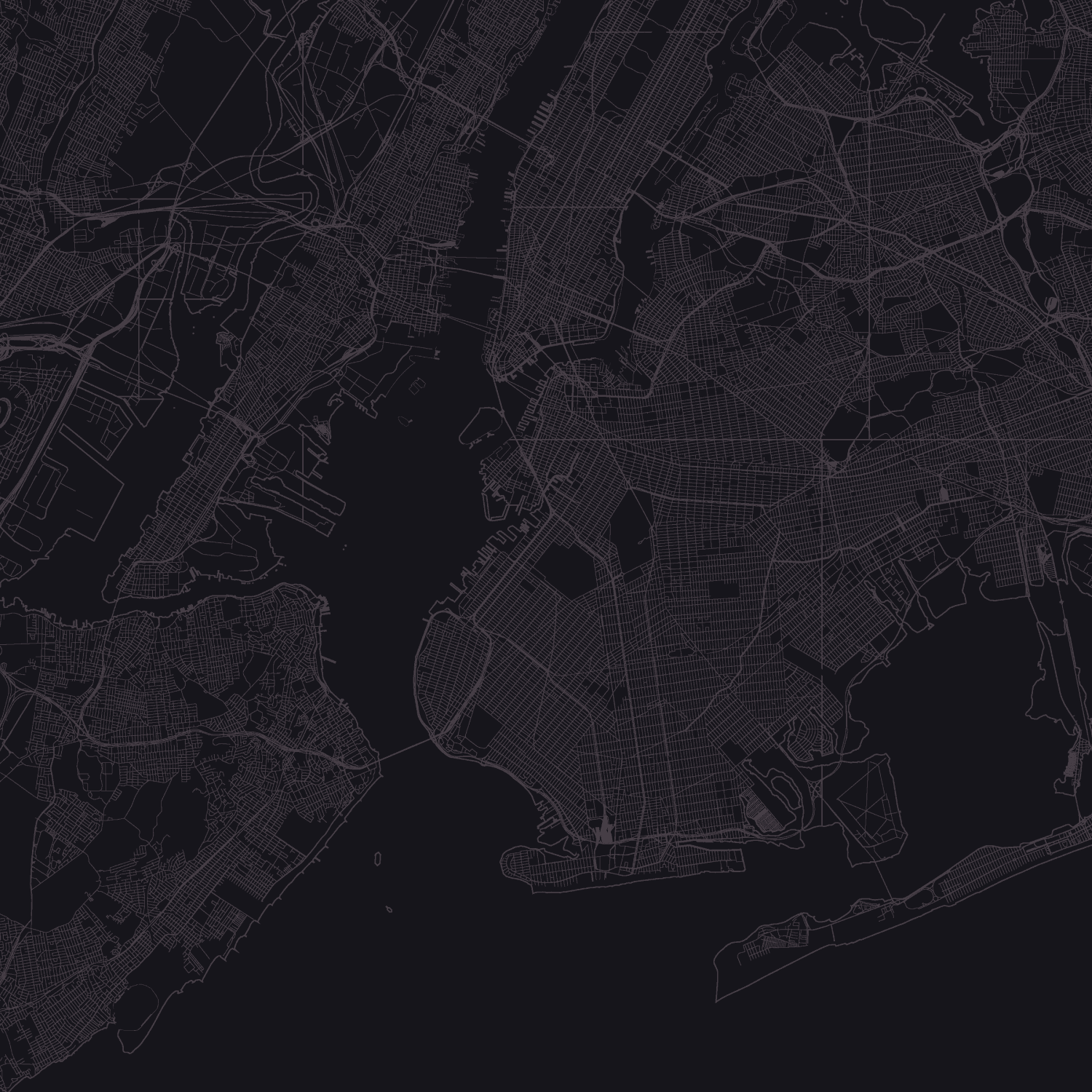

Find a Liberty Tax near you.

become a franchisee

OWN A LIBERTY TAX

Opening a Liberty Tax franchise opens a world of revenue possibility during tax season and all year long.

GREAT SERVICE

"Liberty did not rush me, instead they took the time and gave me great customer service."

EXPERT ADVICE

"They answered all my questions about filing and explained all the new and changing tax laws."

TRULY AMAZING

"Liberty advised me with expert knowledge & care, and leading me to financial peace!"

SERVICIOS EN ESPAÑOL

Hay más de 300 oficinas con preparadores de impuestos bilingües. Llame para disponibilidad.

TAX TOOLS

Helpful calculators, forms and tools to get you the answers you need.

TAX BLOG

Check out all our latest news, helpful articles and financial tips.

REFUND STATUS

Check your state or federal refund status with our tax refund trackers.

$50 REFERRAL

The more friends you refer, the more money you get.*